Activewear Clothing Manufacturers Guide: Concept to Collection

Starting an activewear brand involves a complex trade-off: Quality vs. Cost vs. Speed.

Finding the right activewear apparel manufacturers is the single most critical decision you will make. There is no single “perfect” manufacturing destination. The right choice depends entirely on your business model. Are you a boutique label valuing the “Made in Australia” tag? Are you a mass-market brand chasing the lowest cent in Vietnam? Or are you a performance brand looking for technical scalability?

At Maes Group, we believe in radical transparency. We know we aren’t the right fit for everyone. This guide breaks down the global manufacturing landscape objectively, based on over a decade of supply chain experience, helping you decide which region aligns with your specific stage of growth.

⏱️ Short on Time? Here is the Quick Verdict:

- Choose Australia if: You need “Made in Australia” for branding, have a very high budget per unit, and are producing small, simple batches (Cut & Sew).

- Choose Vietnam if: You are an established enterprise (like Nike/Adidas) ordering 3,000+ units per style to get the absolute lowest labor cost.

- Choose China if: You are a startup or scaling brand needing technical performance (like Seamless Activewear), moderate MOQs (150-300), and a complete supply chain in one place.

- Choose India / Pakistan if: You are producing budget cotton basics (like T-shirts or hoodies) where low cost is the only priority, and you accept variable quality.

2026 Comparison: Activewear Costs & MOQs (Australia, China, Vietnam & More)

(A quick comparison for decision makers)

Here is how the top manufacturing regions stack up against the Maes Group (China) standard for Australian brands.

| Features | China (Maes Group) | Australia (Local) | Vietnam | Bali / Indonesia | India & Pakistan |

| Best For | Performance Brands & Startups | Fast sampling, “Made in AU” marketing | Established Giants (Nike/Adidas) | Swimwear / Soft Yoga | Budget Basics / T-shirts |

| Primary Strength | Tech Innovation & Service | “Made in Australia” Tag | Mass Production Volume | Design Aesthetics | Cotton & Low Labor Cost |

| Cost | Optimal Value (Mid-Cost) | Highest (Labor intensive) | Lowest (At 5k+ volume) | Mid-Range | Low |

| MOQ | High Flexibility (150+) | Low MOQ but extremely high labor costs | High Volume (Strict 3,000+ pcs) | Moderate | Low to Medium |

| Tech Level | Advanced (Seamless / Santoni / Bonding) | Basic (Traditional Cut & Sew) | Standard Assembly | Basic (Limited compression tech) | Low (Basic Cotton) |

| Logistics to AU | Fast & Direct (DDP) | Domestic | Moderate | Fragmented | Slow |

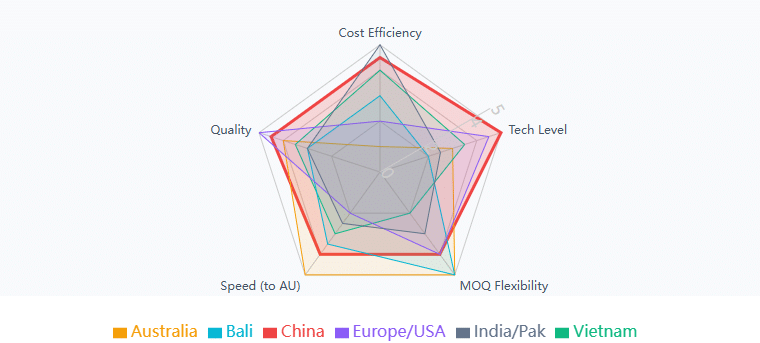

Let’s visualize how these regions stack up against each other. As you can see below, while Australia leads in Speed and Vietnam in Cost, China offers the most balanced ‘Sweet Spot’ for growing brands.

Global Sourcing Comparison: Why Choose China?

Breaking into the fitness apparel market starts with one critical decision: Where should you manufacture? We have compared the most searched global manufacturing hubs directly against the Maes Group (China) standard. The following analysis focuses on cost structures, supply chain efficiency, and technical capabilities.

-

China vs. Activewear Manufacturers in Australia & Melbourne

The Reality: Unmatched Communication, High Overhead.

Searching for activewear manufacturer in Australia (particularly in hubs like Melbourne or the Gold Coast) is the logical first step for many founders. The benefits are clear: same time zone, easier legal recourse, and the ability to visit the factory floor.

The Pros:

- Marketing Value: Use local AU manufacturing for marketing leverage (“Made in Australia” tags carry a premium) or for emergency restocks where speed is the only priority.

- Control: Easier quality assurance (QA) visits and face-to-face meetings.

The Trade-off:

However, the Australian textile industry has shrunk significantly. Most “local” production is actually just final assembly (sewing), with technical fabrics still imported from Asia.

- Cost: Local labor costs are typically 3-5x higher than offshore activewear clothing manufacturers.

- Scalability: If your brand takes off, local workshops often struggle to ramp up volume quickly due to limited machinery and staff.

Maes Group’s Solution: Local Project Management, Global Scalability

If your brand strategy relies 100% on being “locally made,” we recommend sticking with local workshops. However, if you want Australian-level project management but need the profit margins to actually scale a business, Maes Group offers a hybrid model: offshore production with local, native English-speaking support.

-

China vs. Activewear Manufacturer in Vietnam

The Reality: The Volume King.

Activewear manufacturers in Vietnam are the powerhouse of the garment world. If you look at the tag on your Nike or Gymshark gear, it likely says “Made in Vietnam.”

The Pros:

- Price: For orders exceeding 5,000 units, Vietnam often offers the lowest labor cost globally.

- Quality: Excellent standard for traditional cut-and-sew garments.

The Trade-off:

- High MOQs: This is the biggest barrier for startups. Most factories will ignore inquiries under 1,000-3,000 pieces per color.

- Fabric Limitations: While labor is cheaper, Vietnam often lacks a developed local fabric market for high-tech performance materials. They usually have to import these fabrics from China first. This adds time to your lead cycle and eats into the cost savings unless you are ordering massive volumes (like Nike or Adidas).

How Maes Group Solves the MOQ Gap:

As dedicated custom activewear manufacturer, Maes Group fills the gap for brands that aren’t ready to order 10,000 units yet. As leading wholesale activewear supplier in Australia, we offer flexible MOQs (starting at 150 mixed sizes) to help you test the market without overcommitting capital.

The Truth About MOQs: It’s Not Magic, It’s Math.

At Maes Group, we believe in radical transparency. We don’t set MOQs arbitrarily; they are dictated by raw material yields and machine calibration.

Here is the technical breakdown of how we calculate Minimum Order Quantities, so you can plan your collection accurately:

①Cut & Sew Activewear: The “Fabric Roll” Rule

For traditional cut-and-sew garments, the MOQ is almost always determined by the length of a single roll of fabric. We don’t want to waste material, and neither do you.

- Heavier Garments (e.g., Hoodies, Fleece Tracksuits):

Thicker fabric consumes more volume per roll. One standard roll of fleece fabric can typically produce 70–100 hoodies. Therefore, our MOQ for these items is naturally lower. - Lighter Garments (e.g., Yoga Tops, Leggings):

Thinner performance fabrics have a higher yield. One roll can typically produce 100–200 units of tops or leggings.

Verdict: We offer flexibility based on the fabric yield, not just a random number.

② Seamless Activewear: Machine Calibration

Seamless technology involves knitting tubes of fabric directly from yarn. Changing sizes or colors requires stopping the machines and recalibrating the tension and yarn feeds.

- Standard Seamless MOQ: Typically 100–150 units per color, per size, per style.

Note: Seamless production is capital intensive. While the minimums are higher per SKU compared to cut-and-sew, the result is a premium, high-performance garment with no side seams.

-

China vs. Activewear Manufacturer in Bali & Indonesia

The Reality: Aesthetic Focus vs. Technical Limits.

Activewear manufacturers in Bali are globally recognized for resort-wear and swimwear, while broader Indonesia manufacturing is strong in general garment assembly.

The Pros:

- Aesthetics: Incredible eye for design, dyes, and “resort” style branding.

- Low MOQs: Many workshops are friendly to small start-ups.

The Trade-off:

- Technology Gap: Bali is fantastic for swimwear and basic yoga wear. However, it lacks the heavy industrial infrastructure for high-compression seamless technology or high-GSM performance fabrics.

- Logistics: Key materials like high-compression Nylon/Spandex or seamless knits are frequently imported from China, which can lead to longer lead times and supply chain fragmentation.

- Watch Out For: “Island Time.” Frequent religious holidays and a relaxed culture can lead to production delays that you wouldn’t experience in East Asia.

Our Perspective: Upgrading from “Lifestyle” to “High-Performance”

If you are building a soft, lifestyle yoga brand, Bali is a great option. But if your product promise is “High Performance” (runners, cross-fit, gym compression), you need the industrial knitting technology (like Seamless knitting technology) that is concentrated in China. (Below is the texture/pattern of seamless sweatpants produced using seamless knitting technology)

-

China vs. Manufacturers in USA, UK & Europe

The Reality: High Prestige, Logistical Hurdles.

Brands often search for activewear manufacturers in the USA or Europe seeking western manufacturing standards or specific organic cottons (common in Portugal/Turkey).

The Pros:

- Sustainability Perception: Portugal and Turkey are global leaders in organic cotton and sustainable manufacturing practices, which appeals to eco-focused brands.

- Market Proximity: Excellent if your primary customer base is in the EU or North America.

The Trade-off:

- Logistical Facts: For Australian brands, manufacturing in the USA or Europe presents objective logistical challenges. Shipping routes are longer and freight costs per unit are significantly higher compared to the direct trade lanes between China and Australia.

- Material Focus: These regions excel in cotton and natural fibers. However, for synthetic performance wear, China dominates roughly 70% of the global technical textile market.

Maes Group’s Solution: DDP from China to Australia

If you are targeting the European market exclusively, manufacturing in Portugal makes sense. But for Australian brands, the “Landed Cost” (product + shipping + duties) from the USA/Europe is often prohibitive. Maes Group offers DDP (Delivered Duty Paid) shipping from China to Australia, ensuring a streamlined, cost-effective logistics chain.

-

China vs. Manufacturers in India & Pakistan

The Reality: Cotton Specialists.

Activewear manufacturers in India are renowned for cotton production, and Pakistan is a global leader for fleece and hoodies.

- The Category Distinction: If you are producing 100% cotton t-shirts, these regions are excellent. If your brand is focused on high-tech gym gear, the quality consistency here may not meet Australian standards without a strict inspection team on the ground. For seamless leggings, sports bras, and compression wear, they often lack the specialized machinery (like Santoni knitting machines) found in Chinese facilities.

-

China vs The World on Inclusivity (Plus Size)

The Strategy: Directly addressing the demand for inclusivity.

A growing number of brands are searching specifically for plus size activewear manufacturers to serve a more diverse customer base.

- The Challenge: Many factories in Vietnam or Bali operate on standard “Asian Sizing” charts, which can be difficult to adapt for the Western plus-size market (up to AU 24-26) without compromising fit and support.

- The Maes Group Solution: Unlike standard Asian factories that strictly stick to linear grading (causing fit issues), Maes Group utilize Australian-aligned size blocks (AU 4-24) and high-retention fabrics that provide the necessary support and coverage for larger sizes. We believe scaling your size range shouldn’t mean scaling your headaches. In our factory, we often see tech packs where the grading is simply scaled up linearly. We have to correct this manually to ensure the leggings don’t slip down during a squat. This is the difference between ‘making a size’ and ‘engineering a fit’.

Why China Remains the Technical Hub

The Reality: The Complete Ecosystem for Activewear.

Despite geopolitical conversations, China remains the undisputed leader for technical activewear manufacturing. It is not just about “cheap labor” anymore (in fact, China is no longer the cheapest); it is about efficiency and innovation.

The Maes Group Approach:

We don’t claim to be the cheapest option in the world. We claim to be the safest pair of hands for performance brands.

- Technical Edge: As specialized seamless activewear manufacturer, we utilize advanced Santoni knitting machines that other regions lack.

- Speed: Because we knit, dye, and sew in the same district, we reduce lead times significantly.

- Service: We offer DDP (Delivered Duty Paid) shipping to Australia, removing the customs headache for you.

The Final Verdict

After analyzing the global landscape, Maes Group offers the optimal balance for Australian brands:

- Better Price/Performance Ratio than local Australian production.

- More Flexibility (Lower MOQs) than Vietnam.

- Superior Technical Capability compared to Bali or India.

[Contact Our Specialists] to discuss your collection today.

Frequently Asked Questions about Activewear Sourcing

Answer: It depends on your business stage. Choose Australia for small "Made in Australia" batches if you have a high budget. Choose Vietnam for mass production (lowest cost) if you can order 3,000+ units. Choose China (like Maes Group) for a balance of technical innovation (seamless), moderate MOQs (150+), and efficient supply chains for startups and scaling brands. Answer: Vietnam is primarily a mass-production hub geared towards giants like Nike and Adidas. Factories rely on volume to maintain low labor margins, typically requiring Minimum Order Quantities (MOQs) of 3,000 to 5,000 units per style. This makes it difficult for startups to manufacture there without significant capital. Answer: Manufacturing in China is significantly cheaper. Labor costs in Australia are typically 3-5 times higher than offshore options. While Australia offers easier communication, local production is often limited to basic "cut & sew." China offers better profit margins and access to advanced machinery for technical garments at a fraction of the cost. Answer: Seamless technology (using Santoni machines) is concentrated in China. While most factories require high volumes, Maes Group offers specialized seamless manufacturing with flexible MOQs starting at 150 pieces per color per size, bridging the gap between boutique flexibility and industrial performance. Answer: For organic cotton and natural fibers, Portugal, Turkey, and India are global leaders. However, for high-performance synthetic activewear (nylon/spandex blends) required for gym and compression wear, China remains the technical leader, controlling roughly 70% of the global technical textile market.Q1: Which country is best for activewear manufacturing: Australia, China, or Vietnam?

Q2: Why are manufacturing MOQs so high in Vietnam?

Q3: Is it cheaper to manufacture activewear in China or Australia?

Q4: Where can I find seamless activewear manufacturers with low MOQs?

Q5: What is the best destination for sustainable or cotton activewear?